Relief for Borrowers as 23 Kenyan Banks Slash Interest Rates After CBK Cuts

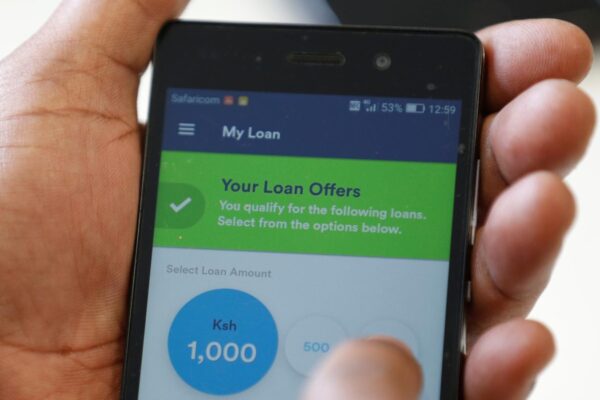

Nairobi Kenya: A total of 23 commercial banks in Kenya have lowered their lending rates following successive interest rate cuts by the Central Bank of Kenya (CBK). The move is expected to make borrowing more affordable and stimulate economic activity across various sectors. According to data released in December, the average lending rate declined to…