Longhorn Publishers Reports KSh 193.3mn Half-Year Net Loss

Longhorn Publishers, financial performance, net loss, revenue, operational challenges, strategic initiatives, macroeconomic factors, digital growth, educational publishing, Nairobi Securities Exchange, share price, fiscal year, CBC Curriculum.

Longhorn Publishers disclosed a revenue of KSh 525.9 million, marking a 3.7% year-on-year increase, yet faced a widened net loss of KSh 193.3 million.

- The company’s gross profit plummeted by 12.3% to KSh 81.7 million, leading to a gross margin of 15.5%, contrasting with 31.3% in 2022.

- Longhorn attributed the 70% surge in printing expenses to currency devaluation and heightened operational costs, resulting in gross margin compression.

Looking forward to the second half of the fiscal year, Longhorn anticipates a more robust performance, forecasting government contracts worth KSh 550 million and opportunities to expand its market share.

Maxwell Wahome, Group Managing Director & CEO, and Francis T. Nyammo, Group Chairman, acknowledged the adverse macroeconomic conditions that impacted the business, including inflation, interest rate hikes, and economic sluggishness. These factors led to reduced spending on textbooks across Longhorn’s markets.

Revenue for the period declined by KSh 61 million, a 10% drop compared to the prior period, with a significant 80% decrease in government revenue due to textbook distribution delays. Operating expenses decreased by 25%, attributed to a streamlined cost structure, while finance costs surged by 44% due to interest rate adjustments.

The company remains optimistic about achieving its digital business objectives, with forthcoming partnerships with telecommunication firms expected to bolster digital revenues. Longhorn also anticipates substantial updates to the CBC Curriculum in 2024 following recommendations from the Presidential Working Party on Education Reform.

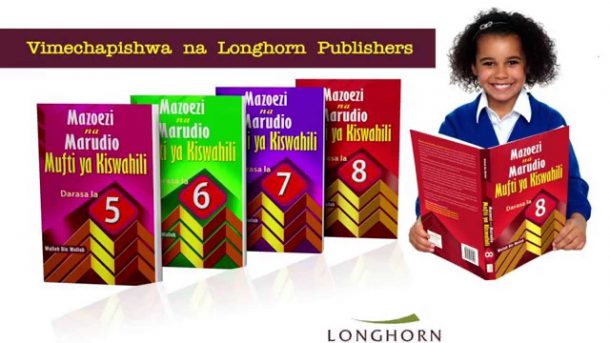

Established in 1965, Longhorn Publishers Limited is a public limited liability publishing entity, catering to educational and general book needs across all academic levels. Formerly known as Longhorn Kenya Limited until November 2014, the company remains dedicated to delivering quality educational materials.

On the Nairobi Securities Exchange (NSE), Longhorn Publishers’ share price stands at KSh 2.25, registering a 2.3% gain from its previous close. Despite starting the year at KSh 2.41, the company experienced a 6.64% decline in share price, ranking it 50th in year-to-date performance on the NSE.