Kenya’s Digital Lending Boom: Central Bank Licenses 7 New Credit Providers, Expands to 58

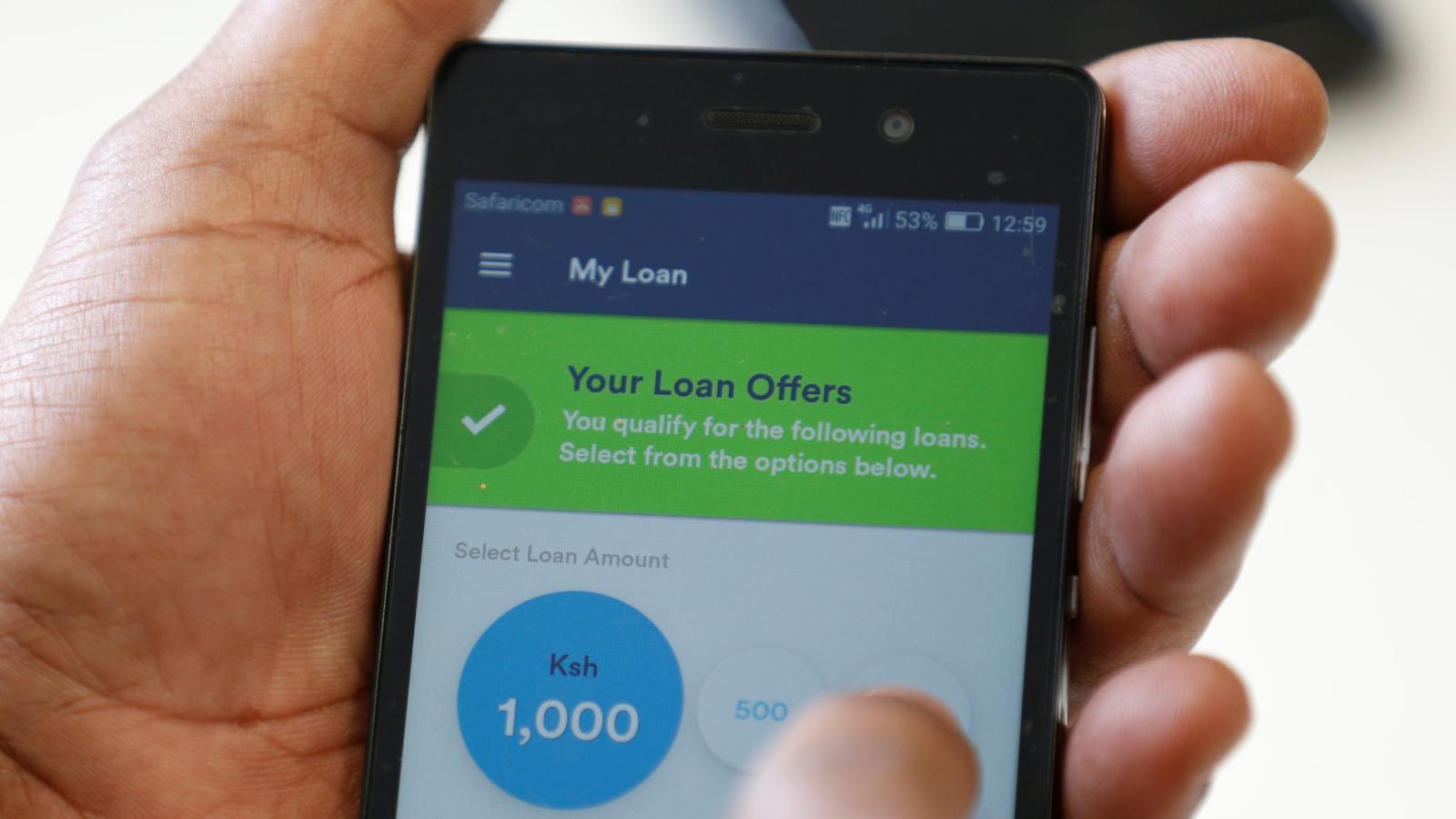

The Central Bank of Kenya (CBK) has taken another significant step in regulating the burgeoning digital credit sector. On June 27, 2024, CBK announced the licensing of seven more digital credit providers (DCPs), pushing the total number to 58. This move underscores CBK’s commitment to creating a well-regulated environment that fosters innovation while protecting consumers.

Growing Number of Applicants

Since the initiation of the licensing process in March 2022, CBK has received an overwhelming response with more than 550 applications. This reflects the rapid growth and interest in the digital lending sector in Kenya. The CBK’s regulatory framework aims to scrutinize and approve providers based on strict criteria related to their business models, consumer protection policies, and leadership structures.

Newly Licensed Providers

The seven newly licensed digital credit providers are:

- Mogo Auto

- ED Partners Africa

- Ismuk

- Stride Credit

- Payablu

- Progressive

These companies join the likes of Lipa Later, Fortune, and Zillions Credit, which were among the initial 19 firms licensed in March. The approval of these additional firms highlights CBK’s ongoing efforts to expand the market while ensuring that all players meet the required standards.

Regulatory Process and Consumer Protection

The licensing process involves rigorous scrutiny of each applicant’s business model and practices. CBK’s primary concern is consumer protection, given the rapid expansion and previous lack of regulation in this sector. By enforcing stringent regulatory standards, CBK aims to prevent exploitative practices and ensure transparency and fairness in digital lending.

CBK’s statement emphasized that many applicants are still in the pipeline, waiting to fulfill the necessary documentation and compliance requirements. This phased approach ensures that only firms meeting the highest standards are allowed to operate.

Impact on the Digital Lending Sector

The licensing of more digital credit providers is a positive development for the Kenyan financial landscape. It opens up the market to healthy competition, potentially leading to better services and lower costs for consumers. Moreover, a regulated environment helps build trust among consumers who have previously been wary of digital lenders due to issues like high-interest rates and lack of transparency.

Conclusion

The Central Bank of Kenya’s licensing of additional digital credit providers marks a significant milestone in the regulation of the digital lending sector. By enforcing strict regulatory standards, CBK is not only fostering innovation but also ensuring that consumer interests are safeguarded. As more providers get licensed, the digital credit landscape in Kenya is set to become more competitive, transparent, and consumer-friendly.