Kenya’s Digital Gold Rush: Unlocking the Financial Markets Potential using Mobile Phones

The Mobile Revolution

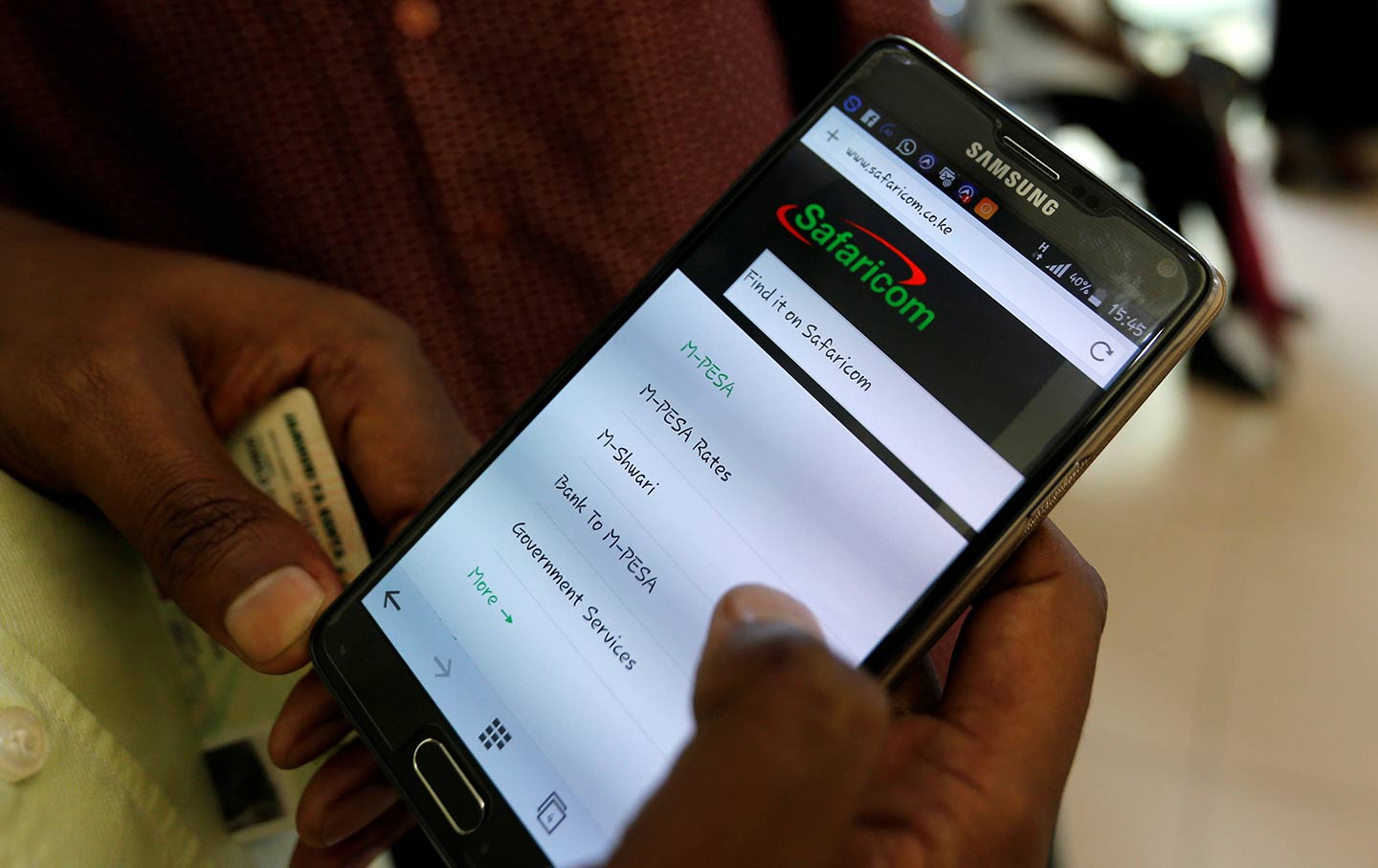

Kenya, with over 32 million smartphones in use, is undergoing a financial transformation. Mobile money platforms like M-Pesa have revolutionized transactions, allowing many Kenyans to save, send, and receive payments without traditional banking. This change has been pivotal for 44% of the population previously excluded from formal banking services.

Now, a new wave of mobile trading apps is democratizing access to financial markets. These apps are easy to use and empower ordinary Kenyans to invest and pursue their dreams of financial freedom. Ken Van Damme, Regional Marketing Team Lead at Exness, notes that mobile technology is leveling the playing field, fostering unprecedented financial inclusion.

Untapped Investment Horizons

Kenya’s entrepreneurial spirit is strong, evident in its vibrant startup ecosystem—the second largest in Africa. Mobile trading platforms have lowered entry barriers to financial markets, allowing more Kenyans to diversify their income and secure long-term financial freedom through smart investments. While the Nairobi Securities Exchange (NSE) remains a central pillar, traders are exploring beyond traditional stocks and currency assets, showing a growing interest in alternative investments like Contracts for Difference (CFDs).

Van Damme highlights the evolving sophistication of Kenyan traders, who now seek a wider range of asset classes. This shift indicates increasing confidence and knowledge among investors.

The Importance of Trust

With the rise of online trading comes the risk of scam brokers. These unscrupulous entities lure traders with false promises of high returns. Van Damme stresses the need for knowledge, risk management, and trustworthy platforms. Exness, a CMA-licensed broker, is committed to providing the tools and regulatory compliance necessary for Kenyan traders to succeed.

The Capital Markets Authority (CMA) plays a crucial role in protecting investors and ensuring a secure trading environment. The emphasis on choosing CMA-licensed brokers like Exness reflects a maturing market focused on investor protection.

A Future of Financial Empowerment

The convergence of mobile technology, entrepreneurial drive, and robust regulatory oversight is reshaping Kenya’s financial landscape. This mobile-powered trading revolution is creating new pathways for economic participation and fostering a culture of financial literacy and empowerment. As this movement gains momentum, it has the potential to redefine Kenya’s economic future and serve as a model for other emerging markets aiming to unlock their citizens’ full potential.

Kenya’s journey towards financial empowerment is an inspiring testament to the power of technology and innovation in driving economic growth and inclusion. By embracing these advancements, Kenya is paving the way for a more inclusive and prosperous financial future for all its citizens.