CBK Report on Commercial Banks’ Credit for Period Ended June 30, 2023

1.0 Commercial Banks’ Credit Officer Survey

The latest survey by the Central Bank of Kenya (CBK) aimed to gauge the lending behavior within the banking sector across all eleven economic sectors. Queries revolved around credit demands, loan approval standards, non-performing loans, credit recovery efforts, and the implementation of International Financial Reporting Standards (IFRS) 9 on Financial Instruments and IFRS 16 on Leases. The survey emphasized changes over the past and forthcoming quarters.

1.1 Background

Credit risk, the primary factor affecting financial institutions, saw a slight increase in the ratio of gross loans to total assets from 56.9 percent in the quarter ending March 31, 2023, to 56.4 percent in the quarter ending June 30, 2023. The CBK quarterly Credit Officer Survey targeted senior credit officers from 38 operational commercial banks and 1 mortgage finance company, aiming to identify potential drivers of credit risk.

1.2 Survey Methodology

The Senior Credit Officers, pivotal in credit and liquidity decisions, provided most of the survey data while collecting inputs from responsible officers for other aspects. The Kenyan Banking Sector witnessed growth, as demonstrated in various performance indicators for the quarter ending June 30, 2023.

1.3 Kenyan Banking Sector Performance

The Kenyan Banking Sector demonstrated growth in the quarter ending June 30, 2023, compared to the quarter ending March 31, 2022. Key performance indicators include:

- An aggregate balance sheet increase to Ksh.7,052.4 billion in June 2023 from Ksh.6,771.7 billion in March 2023.

- Gross loans increasing by 3.3 percent from Ksh.3,852.3 billion in March 2023 to Ksh.3,980.5 billion in June 2023.

- Total deposits witnessing a 6.9 percent increase from Ksh.4,828.3 billion in March 2023 to Ksh.5,160.5 billion in June 2023.

- Deterioration of the asset quality with the gross non-performing loans to gross loans ratio increasing from 14.0 percent in March 2023 to 14.5 percent in June 2023.

- An increase in the capital adequacy ratio from 18.4 percent in March 2023 to 18.6 percent in June 2023.

- A decrease in the quarterly profit before tax from Ksh.65.1 billion in March 2023 to Ksh.55.1 billion in June 2023.

- A decrease in Return on Equity (ROE) from 27 percent in March 2023 to 25.44 percent in June 2023.

- A marginal decrease in liquidity from 49.9 percent in March 2023 to 49.7 percent in June 2023.

1.4 Summary of Credit Officer Survey Findings

- Demand for credit: Most economic sectors experienced an unchanged demand, with notable increments in the Trade and Personal & Household sectors.

- Credit Standards: All eleven economic sectors maintained unchanged credit standards.

- Non-Performing Loans per sector: Forecasts suggest a likely increase in NPLs in the Personal & Household and Trade sectors for the following quarter.

- Credit Recovery Efforts: Banks expect intensified efforts in eight economic sectors, targeting improved asset portfolio quality.

- IFRS 9 on Financial Instruments: Tight credit risk appraisals dominate the sector, ensuring secure facilities and alternative repayment sources.

- IFRS 16 on Leases: 97 percent of respondents had implemented IFRS 16, with a similar percentage assessing its impact on financial performance and position.

- Liquidity Risk: 63 percent of respondents noted improved liquidity, planning to deploy the additional liquidity towards private sector lending, Treasury Bills, and interbank lending, among other investments.

2.0 Survey Findings

2.1 Demand for Credit

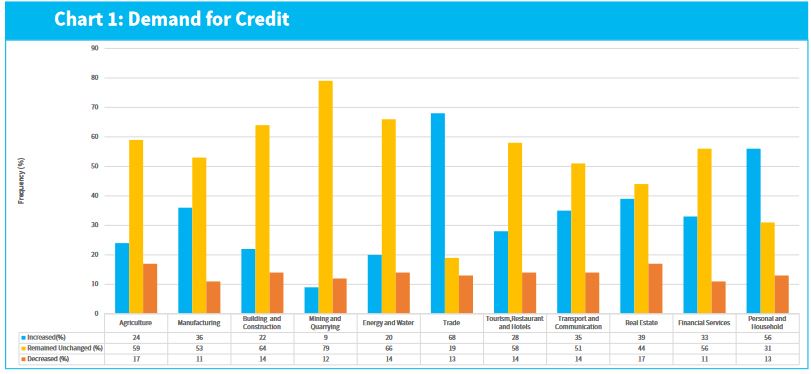

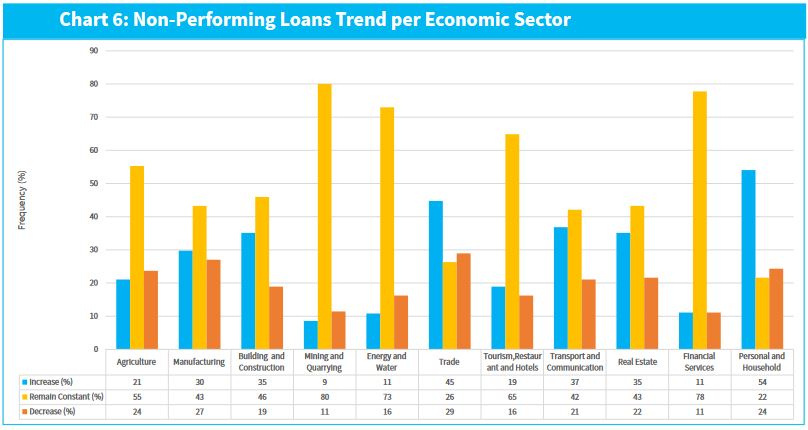

In the second quarter of 2023, the demand for credit remained stable in nine economic sectors and increased in the Trade and Personal & Household sectors. The Mining and Quarrying, Energy and Water, and Building and Construction sectors retained unchanged credit demands.

2.2 Factors Affecting Demand for Credit

In the same quarter, all ten factors influencing credit demand witnessed no significant impact, including the issuance of equity, debt securities, and the COVID-19 pandemic.

2.3 Credit Standards

Credit standards remained unaltered across all economic sectors in the second quarter of 2023, with Energy and Water demonstrating a minor tightening due to COVID-19 and general economic activity expectations.

2.4 Factors Influencing Credit Standards

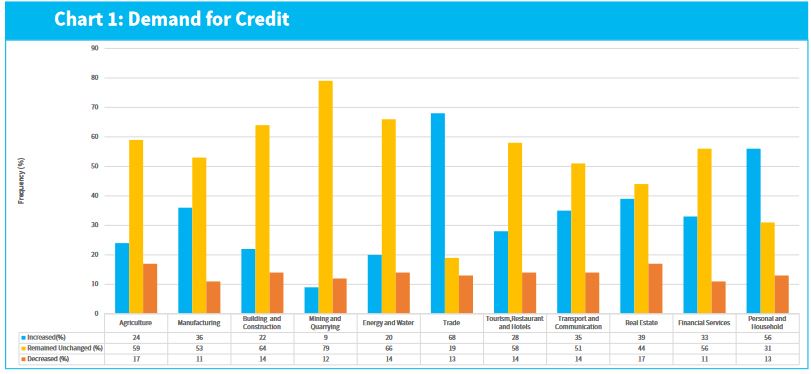

Banks reported that factors like the cost of funds, balance sheet constraints, and the central bank’s retention

of the Central Bank Rate had minimal influence on credit standards in the quarter.

2.5 Non-Performing Loans (NPLs) per Sector

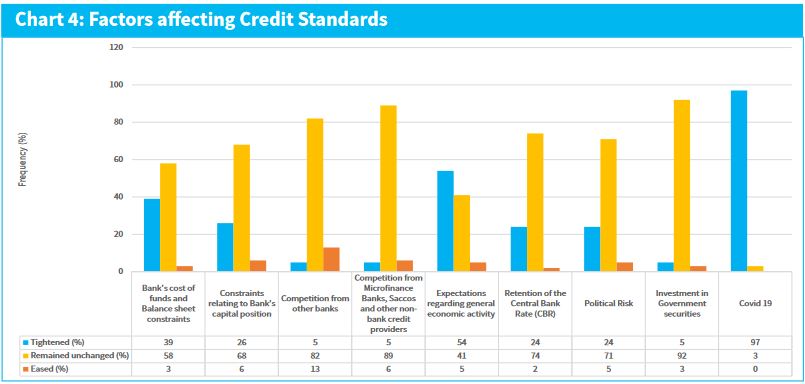

Credit officers projected an increase in non-performing loans (NPLs) in the Personal & Household and Trade sectors for the next quarter, mainly attributed to the general economic environment and repayment challenges faced by borrowers in these sectors.

2.6 Factors Impacting the Quality of Loans

The quality of loans deteriorated in the second quarter, primarily influenced by political risks, economic conditions, and the overall operating environment. Consumer indebtedness and unforeseen events also contributed to this trend.

2.7 Credit Recovery Efforts

Banks expected to intensify their credit recovery efforts across eight economic sectors, with Personal & Household and Trade sectors topping the list. The energy sector remained least affected by credit recovery activities.

2.8 IFRS 9 on Financial Instruments

Banks continued to maintain rigorous credit risk appraisal processes due to the implementation of IFRS 9 on Financial Instruments, aiming to ensure the quality of loan portfolios and provision coverage.

2.9 IFRS 16 on Leases

Approximately 97 percent of the banks surveyed had fully implemented IFRS 16 on Leases. A similar percentage reviewed its impact on financial performance and position, indicating a better grasp of lease-related accounting standards.

2.10 Liquidity Risk

63 percent of surveyed banks observed improved liquidity. These banks intended to utilize the additional liquidity for various purposes, including private sector lending, government securities, and interbank lending. The remaining banks witnessed no substantial change in their liquidity positions.

LIST OF RESPONDENTS

- Absa Bank Kenya Plc.

- Access Bank (Kenya) Plc.

- African Banking Corporation Ltd.

- Bank of Africa Kenya Ltd.

- Bank of Baroda (K) Ltd.

- Bank of India.

- Citibank N.A Kenya.

- Consolidated Bank of Kenya Ltd.

- Co-operative Bank of Kenya Ltd.

- Credit Bank Plc.

- Development Bank of Kenya Ltd.

- Diamond Trust Bank (K) Ltd.

- DIB Bank Kenya Ltd.

- Ecobank Kenya Ltd.

- Equity Bank Kenya Ltd.

- Family Bank Ltd.

- Premier Bank Kenya Ltd.

- Guaranty Trust Bank (Kenya) Ltd.

- Guardian Bank Ltd.

- Gulf African Bank Ltd.

- Habib Bank A.G Zurich.

- HFC Ltd.

- I & M Bank Ltd.

- Kingdom Bank Ltd.

- KCB Bank Kenya Ltd.

- Commercial International Bank (CIB) Kenya

Limited. - Middle East Bank (K) Ltd.

- M Oriental Bank Ltd.

- National Bank of Kenya Ltd.

- NCBA Bank Kenya Plc.

- Paramount Bank Ltd.

- Prime Bank Ltd.

- SBM Bank Kenya Ltd.

- Sidian Bank Ltd.

- Spire Bank Ltd.

- Stanbic Bank Kenya Ltd.

- Standard Chartered Bank (K) Ltd.

- Victoria Commercial Bank Plc.

- UBA Kenya Bank Ltd

3.0 Our Thoughts

The Central Bank of Kenya’s survey shed light on several crucial aspects of the banking sector, including the demand for credit, credit standards, non-performing loans, credit recovery efforts, and the impact of IFRS 9 and IFRS 16. With notable trends in key economic sectors, banks remain vigilant in their risk management and credit evaluation strategies to maintain a robust and stable financial system in Kenya. The observations and projections gleaned from this survey can guide regulatory bodies and banks in implementing necessary measures to sustain a resilient banking sector amidst ongoing economic challenges.