Artificial Intelligence’s Impact on Financial Inclusion in Africa

Its hard to believe there was a time before everyone had smartphones in Africa? Back then, if you weren’t using cash or trading goods, you were probably relying on postal services for transactions. But now, with the rise of mobile technology, things have changed dramatically, especially in finance.

Artificial Intelligence (AI) is the new player in town, shaking things up just like mobile payments did. This technology isn’t just catching up with the rest of the world; it’s pushing ahead, creating exciting opportunities for those without traditional banking access.

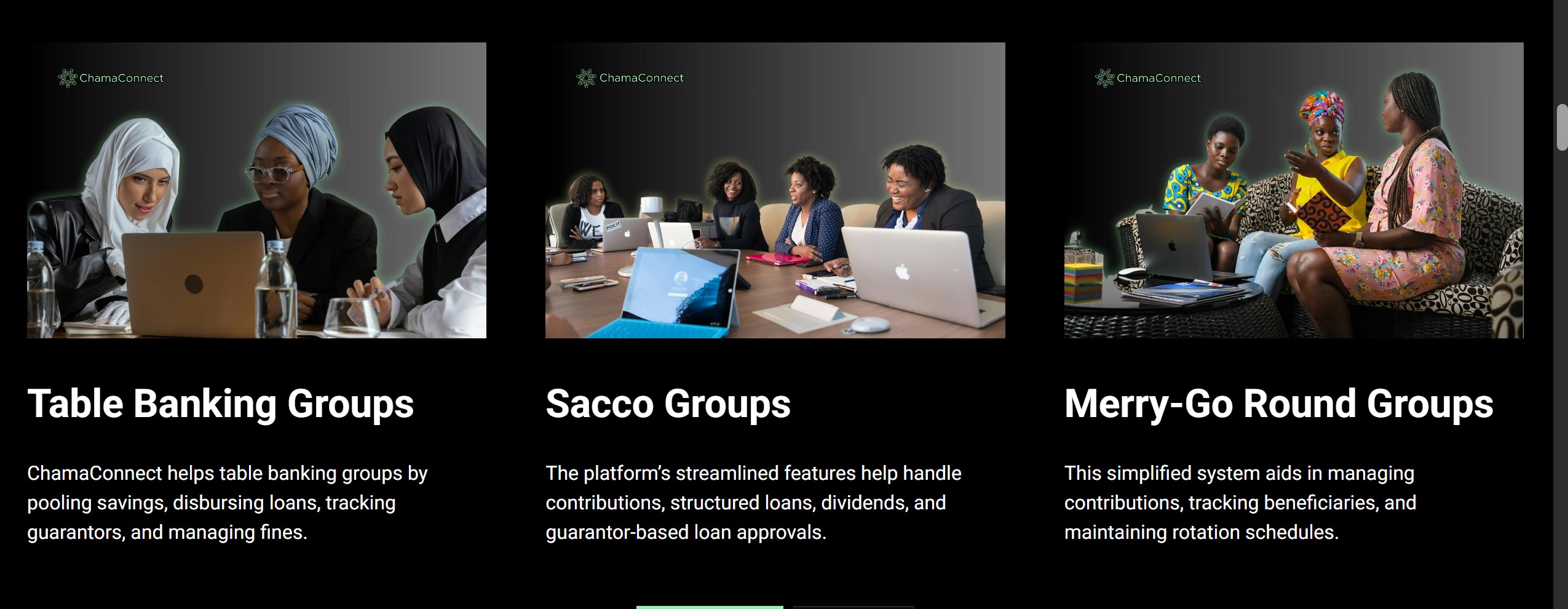

Local fintech companies are leading the charge, transforming how people handle money. They’ve made it easier to access vital services, like buying airtime, which is now much cheaper thanks to these innovative solutions. In fact, according to McKinsey, these services cost up to 80 percent less than what traditional banks used to charge.

Considering that half of Africa’s population still doesn’t have proper banking services, it’s clear how much fintech has changed the game. Take Kenya, for instance, where digital payments boosted financial inclusion by 25 percent in just 15 years.

Cloud technology has also stepped in, giving fintech companies even more power to reach more people. Companies like Flutterwave have moved to platforms like Microsoft Azure, allowing them to process large volumes of payments efficiently. This shift has revolutionized payments in Africa, offering various options like local cards, mobile wallets, and bank transfers.

Now, with AI joining the scene, businesses don’t need big datasets or fancy computers to benefit. Cloud providers offer the necessary computing power, making AI more accessible. This technology isn’t just helping companies like Flutterwave expand; it’s also making financial services more accessible in many ways.

AI’s ability to cut costs is a game-changer, especially for small businesses. By using AI-powered chatbots, banks can handle routine tasks without extra fees, making services more affordable for customers. These chatbots can also help improve financial literacy, offering personalized advice like budgeting tips.

AI isn’t just about cost-cutting; it’s also streamlining processes. Fintech companies can analyze data and create legal documents quickly and affordably, making services more accessible and understandable.

One crucial area where AI shines is real-time lending. Companies like M-KOPA use AI to manage lending risks, allowing them to offer digital loans at scale. This approach has helped millions access essential services like solar power, health insurance, and smartphones.

But for AI to reach its full potential in Africa, we need to invest in infrastructure, skills, and regulations. Microsoft, for example, is working on improving internet access and providing essential tools to boost digital capacity. Collaboration between industries and governments is also key to unlocking AI’s benefits in financial services.

Africa has been a trailblazer in payment technology, and AI could take us even further. To make this happen, we need to lay the groundwork now for an AI-powered future in finance.