Kenya Reinstates 6% Digital Service Tax in An Aim To Boost Digital Economy Revenue

The Kenyan government has revived the 6% Digital Service Tax (DST). This tax, initially suspended, is now back, targeting profits from various online services provided to Kenyan consumers. The decision comes amid efforts by the government to broaden its tax base and capture revenue from digital companies benefiting from local markets without a physical presence.

This reinstatement affects a broad range of businesses, from global giants like Facebook and Netflix to smaller digital enterprises offering services to Kenyan residents. With the demand for digital services surging, this tax aims to ensure that foreign and local digital service providers contribute their fair share to Kenya’s economy.

What is the Digital Service Tax?

The DST is a tax imposed on revenue generated by digital services accessed in Kenya. Unlike traditional corporate taxes, which rely on a physical presence, the DST applies to digital services where providers may have no local offices or direct local operations. Essentially, it covers all digital platforms, including streaming, online ads, e-commerce, and cloud-based services, that generate revenue within Kenyan borders.

The government first introduced the DST in 2020 as a means of capturing untapped revenue from the digital economy. At the time, it was hailed as a progressive move to modernize Kenya’s tax system. However, implementation faced backlash from businesses and consumers who argued that it could hinder digital innovation and lead to higher service costs.

Why Was the Tax Suspended?

The DST suspension occurred as the government reassessed its approach to taxing digital services in line with international practices. Globally, the digital economy has proven challenging to tax under traditional frameworks, and many nations are grappling with similar issues. Kenya, being part of these global conversations, took a brief pause on the DST to align its strategies with the Organization for Economic Cooperation and Development (OECD) discussions on a global digital tax standard.

Critics of the DST had highlighted potential conflicts with international tax agreements. Some argued that the DST might discourage foreign investment in Kenya’s digital market. Furthermore, digital service providers, particularly international ones, were wary of paying multiple taxes across various countries where they operate. This opposition led to a suspension while global tax discussions continued.

However, with the global tax negotiations stalling, Kenya’s decision to reinstate the DST reflects its determination to proceed independently and benefit from the digital economy rather than wait indefinitely.

How the 6% Tax is Applied

Under the DST, digital service providers operating in Kenya are required to pay a 6% tax on gross revenue generated within the country. This applies to revenue from digital content, online marketplaces, subscription-based services, and other online transactions.

The tax calculation is straightforward. The 6% is applied directly to the gross transaction value, meaning providers must calculate the tax on every transaction with a Kenyan consumer. This approach captures a diverse range of digital activities, from video streaming subscriptions to in-app purchases and online advertising revenue.

For example, if a streaming service provider charges a Kenyan consumer $10 per month, the DST on that transaction would be $0.60. For companies with substantial Kenyan user bases, these amounts add up quickly, potentially impacting pricing strategies or leading to adjustments in service terms to absorb or pass on the cost.

Who Bears the Cost?

One significant question surrounding the DST is whether companies will absorb the tax or pass it on to consumers. In many cases, global companies with extensive resources may adjust their business models to accommodate the tax without significantly affecting consumers. However, smaller or more regionally focused digital providers may face challenges absorbing the tax, potentially leading to increased service costs for end-users.

Consumers in Kenya could see a rise in costs across various digital services. From streaming subscriptions to e-commerce transactions, many companies may adjust prices or add surcharges to offset the DST’s impact. This could strain consumers’ pockets and impact the adoption rate of digital services in Kenya.

Potential Impact on Digital Innovation

While the DST is designed to capture revenue from a booming digital market, it also raises concerns about its impact on Kenya’s digital growth. Some experts argue that the tax could stifle innovation by creating additional financial burdens for digital startups, especially those seeking to expand in Kenya.

Local digital startups and smaller players, already facing a competitive market dominated by global giants, may find it challenging to operate profitably under the DST. In particular, businesses that rely on low-margin models may struggle to remain viable with the additional tax.

The DST could inadvertently discourage some companies from entering the Kenyan market or from innovating new digital services locally. It’s a delicate balance for the government: raising revenue while supporting the growth of Kenya’s digital economy.

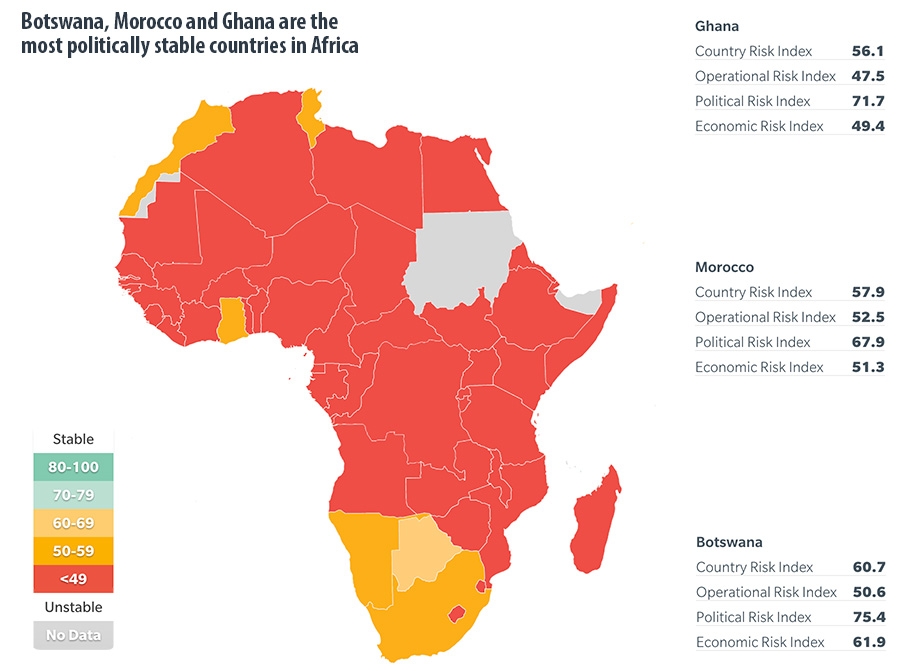

Comparison with Other African Countries

Kenya is not alone in its efforts to tax digital services. Several African countries, including Nigeria and South Africa, have implemented similar digital service taxes to capitalize on the digital economy’s growth. However, rates and structures vary widely. For instance, Nigeria’s 7.5% Value-Added Tax (VAT) applies to digital services, while South Africa requires foreign digital suppliers to register for VAT.

Comparatively, Kenya’s 6% DST is competitive, though its direct application on gross revenue is unique. Other African countries typically impose taxes based on net income or as part of a broader VAT regime. This distinction is significant because taxing gross revenue, as opposed to profits, can create a heavier burden, especially for digital services with high transaction volumes but low profit margins.

Stay Ahead with MUIAA

For Kenyan businesses seeking to thrive in a competitive and regulated environment, adapting to tax policy changes like the DST is essential. MUIAA Ltd. offers comprehensive support to help companies meet these challenges head-on. Our solutions enable Kenyan companies to grow, innovate, and lead by offering customized tailormade financial solutions.

Visit muiaa.com to learn more about how we can help by empowering your business for sustainable growth. Contact us today to speak with one of our experts and find out how MUIAA Ltd.